*Note: This is an informal note that is not directly related to my last essay. The second part of that is still to come.*

Notwithstanding the headline, I don’t really think that panic accomplishes anything useful. But I am amazed that we are looking at a catastrophe and hardly anyone is talking about it. The current situation is the opposite of the “food crisis” that I addressed last year. At the time I talked about how even though there were a lot of bad headlines when you looked into the actual numbers there was no crisis in the immediate near term (it might be different now at least in terms of rice, but I have not really dug into the numbers yet for this year). But in terms of the US deficit, very few people seem to be panicking and yet when you dig into the numbers they are really bad.

So I thought I would write a short informal piece to break down the headlines that I have been linking to and explain why they represent a catastrophe in the making that will directly impact your life. Let us start with a recent CNN story titled “Federal budget deficit expected to nearly double to around $2 trillion.”

Now, if you are a typical American redneck, you will see a head line like that and sagely tell whoever is next to you “the politicians are going to bankrupt this country” and then go on with your business without giving the headline another thought. And who can really blame the typical redneck for reacting like that? In 2020 the Federal Government ran 3.1 trillion dollar deficit and in 2021 the feds ran a 2.8 trillion dollar deficit. It is true that in 2022 the deficit was just over a trillion dollars but if the world did not come to end back in 2020 or 2021 then, why should a mere 2 trillion dollar deficit be a cause of panic today?

If you are a little more educated and curious then the typical American Redneck you will stop and think “Those trillion dollars deficits were because of Covid. It used to be that a one trillion dollar deficit was unheard of. Why are we running a two trillion dollar deficit when the Covid emergency is over?” Fortunately for you the CNN story linked above does a reasonably good job of explaining this even if they don’t spell out the implications or try to whip people up into a panic.

First CNN tells you that “Tax receipts were an estimated 10% lower in the first 10 months of the fiscal year, compared to the same period in the prior year.” Okay, so sometimes tax receipts come in higher than expected and sometimes they come in lower than expected. Those are the breaks and this is nothing to get excited about.

Next CNN goes on to explain that….

“Spending on Social Security benefits jumped 11%, mainly because of a hefty annual cost of living adjustment stemming from a spike in inflation and because more people have joined the entitlement program as the Baby Boomers age.

Medicare outlays increased 18% because of changes in payment rates and in the types and amount of care beneficiaries received, the CBO said. And federal spending on Medicaid rose 6% because of a surge in enrollment due to a now-expired congressional provision that barred states from terminating recipients during the coronavirus public health emergency.

In addition, spending on education, defense and veterans’ health care services all increased.”

For those of us raised on the stories of how Social Security was going to bankrupt America, this is a lot more concerning. Social Security first started dipping into the Trust Fund (which is practice just means the feds have to issued debt to pay for Social Security to cover the shortfall) in 2021 and it is not going to get any better. In 2010 when the first Baby Boomer turned 65 there were just under 40 million people in the US who were over 65 years old. When the last of those classified Baby Boomers turns 65 2030 there is projected to be just over 70 million people in the US over 65 years old. That an almost doubling in 20 years.

But to look at it another way, we are estimated to be about 60 million people over 65 right now. If the world is not coming to an end now, will another 10 million people over 65 really be the end of the world? The answer to this question is that the world is coming to end now, it just that people have not figure it out yet. Going back to the CNN article…..

“Even more notable, spending on interest on the public debt skyrocketed 34%, mainly because interest rates are much higher than they were in the first 10 months of fiscal 2022. Interest rates on Treasury securities are at or near 16-year highs and are higher than the CBO projected in February.”

This is the end of the world type stuff. This is the doom loop that is going to bring a lot of pain and suffering starting in the next year or two and not stopping until the country can’t pay its debts. But CNN does not really explain that fact to you. All they do is close with this quote…..

“We made a lot of economic policy assuming that interest rates would always be low and assuming that revenue would be strong,” Goldwein said. “That can change quickly, and when it does, you can’t undo past decisions.”

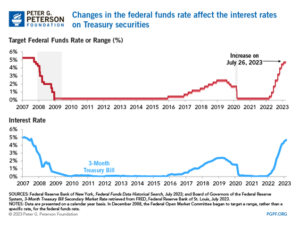

That is a very true statement particularly as it relates to interest rates. But what frustrates me is that that they avoid spelling out what “interest rates are much higher” means in concrete terms. To truly understand what a serious issue “interest rates are much higher” is you need to look at the below chart from the Peterson Foundation…..

As you can see from the above chart, “interest rates are much higher” means a 500% increase in the interest rate paid on 3-month Treasury bill from the pandemic. In fact, you have to go back to 2007 to see when the fed funds rate was last at this level. For the last 15 years, the fed funds rate has never been higher than half of what it is now and for most of that period it was right about zero. During this period, trillions of dollars of debit were issued but the amount the federal government had to pay in interest did not increase by all that much because interest rates were so low. But now those rates are up by 500%, the amount of interest that the federal government has to pay is going to rise in a hurry.

To understand why it is going to raise so much so fast, you first need to understand that most of the debt that the federal government has issued is very short term. As it comes due, the feds have to reissue it at current rates. So this increase in interest rates will impact not just the new debt, but all the outstanding short term debt that has to be renewed. And that short term debt breaks down as follows…..

Treasury Bills: These securities have a maturity of one year or less and they represent about 18 percent of total outstanding Federal debt. Because they are so short term, I am pretty sure that the bulk of the 34% increase in interest payments that occurred this year stemmed from rolling over these short term bills at today’s much higher rates. But this is only 18 percent of the debit and that is why the increase in federal interest payments has “only” been 34% to date.

Treasury Notes: These securities have a maturity of two years up to 10 years and they make up about 55% of all outstanding federal debt. If you look at the chart above, all treasury notes (with the exception of those issued this year) were issued when interest rates were much lower than they are now. So as these notes are refinanced over the next 10 years they will relentlessly drive the federal interest payments higher and higher. Their overall impact will be much greater than the 34% increase in interest payments we have already seen but because the lowest maturity is 2 years and the highest is 10 years it will take a few years for the full impact to be felt.

And all the rest: The above is the bulk of the short term debt. There are also things like Floating Rate Notes that automatically adjust to current interest rates, but they only account for 2% of outstanding federal debt and their sting has already been felt by their very nature. There is also inflation indexed debt, but that amounts to only about 8% of the total outstanding debt and some of that is long term (30 years). This debt is more tuned to inflation rates then interest rates and so it is not as expensive as it was at the height of the post pandemic inflation.

What about the long term stuff? As time goes on, Treasury Bonds will add to the pain. But these bonds have maturities that are over 10 years so some of these were issued back when interest rates were high so it will take a few years before they really start adding to the pain. And when they do, it will not be to the same extent as Treasury Notes as they are only about 17% of the total outstanding Federal Debt.

The next obvious question is why should we expect interest rates to stay elevated? After all, the fed funds rate and the interest rate paid on T-Bills were close to zero for most of the last 15 years. So why can’t they go to zero again?

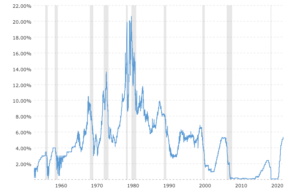

The first answer to that question is that the last 15 years were a very abnormal period in American history. If you look at the chart of the fed funds rate below you will see that….

Source: https://www.macrotrends.net/2015/fed-funds-rate-historical-chart‘

Looking at the above chart, you can see that it was not normal for the US to have such low interest rates. And you can imagine the pain we would be in if rates started climbing to the heights seen in the early 80s. But just saying that it is not normal on historical standards, does not explain a lot. It was not normal for people to have cell phones or for gay marriage to exist back in the 80s either. But no one expects that those things are going to disappear and go back to how things were in the 80s. So why should we expect the current interest rates to go back to the historical norm?

A full answer to this question would be long and complex and I am trying to keep this informal. So I am going to go with a simple answer that explains 80% of the reason. And the simple answer is the US trade deficit.

Now most people think of the trade deficit as being a result of unfair competition by foreign countries or some such thing. But the truth of the matter is that a trade deficit is just the result of foreign countries investing in American or loaning money to American (mostly the latter). The norm for most of my life has been for US consumers to save very little money and for the Federal Government to borrow lots of money. What enable these things to coexist without creating inflation was the large amounts of foreign goods pouring into the US.

If you are having trouble understanding this, just remember that inflation is a matter of how much money is chasing a set amount of goods and services. If you are bringing more goods into the country then you are exporting (a trade deficit) then you are increasing how much money can be in the country without causing inflation. Now if you keep that in mind, let us look with how the trade deficit lines up with the Federal deficit.

As an example of how things used to be we will first look at 2014. In 2014 the trade deficit was just over 500 billion dollars and the federal deficit was 483 billion dollars. What this means is that foreign countries loaned the US enough money to cover its federal deficit with some left over to go to other uses. Because so much capital was coming into the country from other sources, the Feds Funds rate that was pretty close to zero and yet little inflation was observed. And this was typical of how it was in American for the 12 years leading up to the Covid epidemic.

I don’t think it would surprise anyone that while Covid is raging, the Federal deficit far exceeded the trade deficit and to a certain extent that was counter balanced by the fact that business practically came to a halt an so there was less competition for capital. But the Federal deficit was still higher then what foreign sources of capital were willing to provide in 2022 when things more or less “returned to normal.” In 2022 the US trade deficit was 945 billion and the US federal deficit was 1.4 trillion dollars. In other words, the US government needed almost half a trillion dollars more than foreign sources were willing to provide in a year that was supposed to be “normal.” And to a certain extent it was normal in that businesses started wanting capital again. This combination of federal demand and the private sector coming back to life sent interest rates started soaring in 2022.

Like I said before, this is only a rough outline of what happened. What is going on in the private sector has an impact and how the savings rate varies with time are other factors that go into setting interest rates. But for most of my life the primary factor keeping interest rates low in the US was the vast amounts of foreign money pouring in. And that money is still pouring in but not in a sufficient amount to cover the ever increasing federal deficit. In other words, the rest of the world might be willing to loan us a trillion dollars, but when the federal deficit is two trillion dollars that is far short of what we need in order for interest rates to stay as low as we have been used to over the last 15 years.

To understand why this matters, you first need to understand that borrowing money has benefits and costs. The benefits of borrowing money revolve around how much money you borrow. In other words, the more money you borrow, the more you can do with money (buy a bigger house or a fancier car). The costs of borrowing that money depend on how much you have to pay in interest and that depends not just on the amount of money you borrow but on the rate of interest. For example, it costs just as much to borrow 5 thousand at 1% as it does to borrow 1 thousand at 5% even though the benefits of have 5 thousand are much greater than having 1 thousand.

To put that in context of American recent history, we have noted that during the height of pandemic the US government borrowed over 3 trillion and this year the feds are “only” on track to borrow two trillion. But if you factor in that feds funds rate was less than 1% during the pandemic and it is over 5% now, the cost of that two trillion is the equivalent the cost of borrowing more than 10 trillion dollars back in the pandemic. To make matters worse, about 50% of that 3 trillion that was borrowed is going to be re-priced to current rates over the next few years. In other words, the trillions and trillions of almost “free” money the feds have been borrowing over the last 15 years is going to start costing the entire nation a lot more money than when it was issued.

The first way this going to start hurting the average American has already started. People have to pay more for mortgage to buy a house and businesses have to pay more for their capital. We as a nation have gotten used to the low interests rates that were the result of foreign money pouring into the US. But now we as a nation want to borrow more money than foreign sources are willing to give out and as a result interest rates are rising to rebalance supply and demand.

But it is the start of the doom loop that really threatens to disrupt society as we know it. A doom loop in this context is when you have to borrow money to pay your interest payments to people you already owe money to. No person, business, or nation starts the doom loop and avoids bankruptcy (or in the case of some nations, massive inflation). In theory, the US is not in a doom loop yet. In theory, the US government could cut spending enough or raise taxes enough to pay its interest bill. But in practice this is not possible.

In 2022 discretionary spending (anything that is not an entitlement or an interest payment such as defense spending, education, farm subsidies, and other like payments) was 1.7 trillion dollars. The deficit this year is expected to be two trillion dollars. So if costs continued the same this year as they were in 2022, you could cut all defense spending, all education spending, all spending in the farm states, all VA benefits, and you still would have to borrow money to pay all the remaining bills. The only possible way to balance the budget is to cut Social Security and/or Medicare deeply. But it is to late for that. The Baby Boomers are the most important voting demographic in the US and they are not going to vote for cutting their benefits. They might vote to cut their children’s benefits, but they are the ones who are going to bankrupt the nation over the next 10 years.

The ever increasing interest rate costs are soon going to make it so that even deep cuts to entitlements will not balance the budget. In 2022 the Federal Government had to pay 475 billion dollars in interest payments. That amount has increased by over 160 billion this year so the Federal Government is going to spend over half a trillion dollars this year in interest payments alone. By next year I expect that figure to be around 1 trillion dollars in interest payments and I expect that it will keep going up and up from there. Once interest payments go above 10% of GDP (about 2.6 trillion dollars in today’s dollars) we are in a doom loop for sure and there is no escape from bankruptcy judging by the historical record. Granted, we are not there yet but we are on track to get there in about 5 years if nothing changes.

Part of this rapid increase in the interest costs will come from the re-pricing of old debt to current costs but part of this increase is going to be from the fact that every one trillion dollars of new debt is about 50 billion dollars in new interest payments at current pricing. Thus, this year’s new borrowing alone is going to raise interest cost for the federal government by another 100 billion dollars. Even if you figure that the re-pricing of old debt will only increase current interest costs by about 160 billon dollars then total interest costs are going to be 895 billion by the end of next year just by adding the costs of the new debt and modest increase in the costs of the existing debt load to the current costs. But I am figuring that the actual interest rates that the that the feds have to pay will increase over the coming year so I am assuming that federal interest costs will be in the neighborhood of 1 trillion dollars by close of fiscal year 2024. Even if I am wrong about the increase in rates from today’s costs, it is a simple mathematical fact that running deficits in the range trillions of dollars a year will rapidly bring interest payments to 10% of GDP if your interest rates stay at the 4% to 5% range.

Keep in mind that all during this period, Social Security and other entitlement spending will be going up. This will only increase the deficit which in turn will only increase the amount of interest payments. And in turn, the increase in interest payments will increase the deficit and so on and so forth until interest payments overwhelm everything and the US goes bankrupt.

It is always possible that I am wrong. Maybe the interest rates will go back to zero without creating massive inflation. Maybe the economy will grow by so much that the tax intake will close out the deficit. Maybe some foreign benefactor will pour trillions of dollars into the US economy. Or maybe the government will hike taxes by so much they will close the deficit.

But the thing that bugs me is that the mainstream consensus is not predicting any of those things that would make me wrong. Most economists feel that interest rates are returning to historical norms. Most people don’t expect the US rate of economic growth to suddenly increase from what they have been these last 10 years. No one is looking for the trade deficit to double or triple in size overnight (which is what would be needed to cover US Capital needs). And no one expects the kind of tax increase that would be necessary to close the deficit. At the same time, nobody is publicly adding these facts together and telling people what the obvious conclusion is.

In other words, everything I have been saying is the consensus opinion in so far as the individual parts that make up my argument go. But if you add all the facts together you get a rapidly approaching disaster. Soon interest payments on the federal debt will be more then all defense spending combined (probably next year or the year after that). Shortly after that it will be more then all discretionary non-defense spending combined. Then interest payments will be greater than all discretionary spending. At that point default or massive inflation will be the only way out. There will be no tax increases or spending cuts that will be able to stop the doom loop. And unless interest rates drop sharply or entitlement spending cuts are suddenly a vote getter, this is all going to happen in the next 5 years or so.

But for some reason, nobody seems to be panicking.